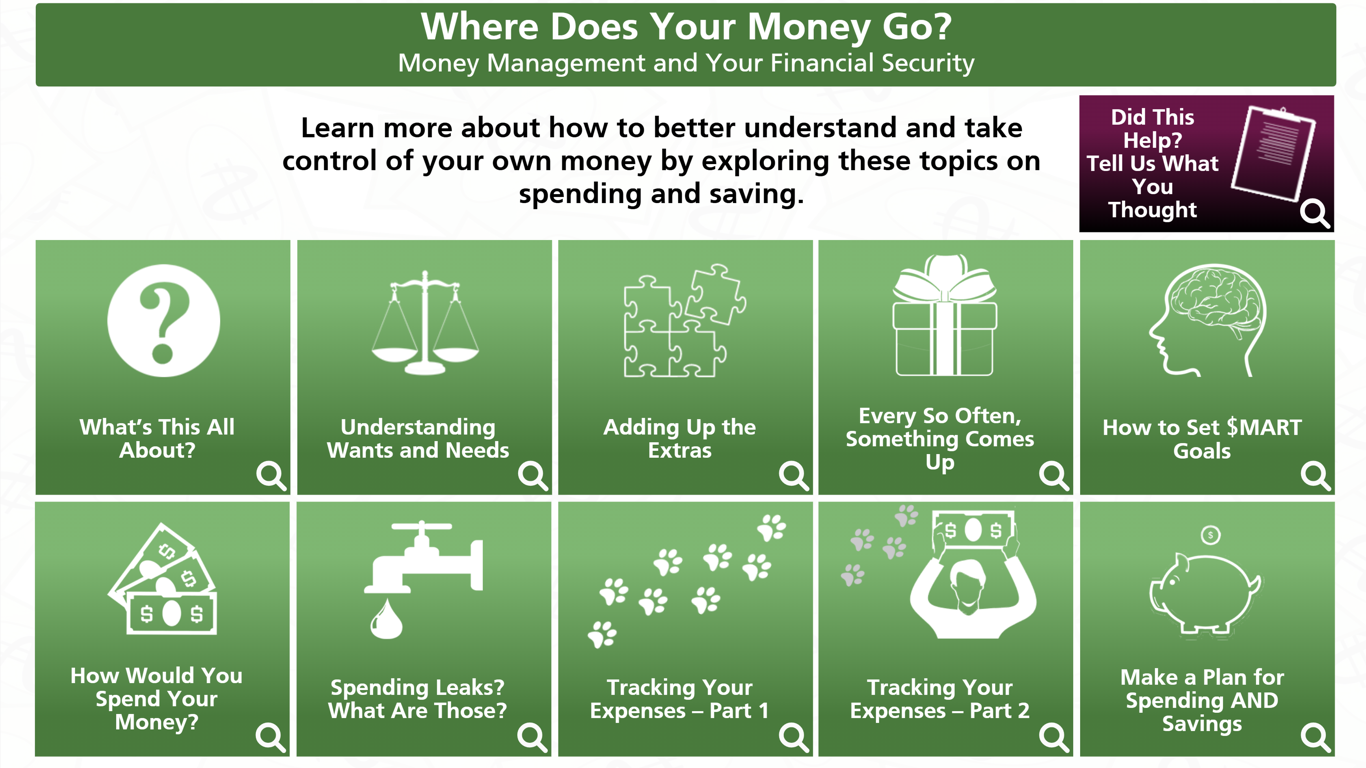

Where Does Your Money Go? is a financial capability program designed to help consumers better understand how they spend their money, including having participants discover their “spending leaks”, identify their financial priorities, and then make a spending plan tailored to their financial needs and designed to achieve their personal goals..

- Responsibilities: Instructional Design, eLearning Development, Supplemental Content Development, Multimedia Design and Development using a combination of traditional and generative AI techniques, JavaScript coding

- Target Audience: Generally adults and older teens

- Tools Used: Articulate Storyline, Krita, Reallusion Cartoon Animator, Generative AI

- Budget: Low

- Client: Purdue University Extension – Health and Human Sciences

- Year: 2023

Overview

The client’s goal was to replace the existing online version of this program, one with demonstrated poor engagement and completion follow through, with an updated version that better engages their target audience and provides a similar experience to that received during attendance of the in-person two day workshop.

64% (166 million adults) of the U.S. population say they are living paycheck to paycheck, and according to January 2022 poll from Bankrate, 56% of respondents say they can’t cover a $1000 emergency expense with savings. Individuals aren’t learning personal finance in school and lack the basic skills necessary to move forward with improved financial decision making.

This project will represent an online asynchronous version of the program and is a basic personal finance approach that can help these individuals learn how to save. This digital offering will help them learn at their own pace, and most importantly make participation viable for individuals who are otherwise unable to attend any in-person workshops due to time, work, family, or travel constraints.

Project Origins

The client mentioned that while an online version of this program existed already, a large driver for the new project was the poor reception this program received. and the very low levels of completion recorded.

Design Approach

{Optional summary of the justifications for the basis of the design. May include problems identified, theories used, project specific definitions, and sample integrated content – a few lines to several paragraphs}

Process

Review of the existing online program revealed a combination of linear design, difficult navigation, and direct transfer of learning materials from the in-person workshops. SInce in-person and virtual (especially asynchronous) education are not generally interchangeable, the issues the program experienced are understandable. Coupling this with the loss of learning autonomy the design implemented only exacerbated the problems.

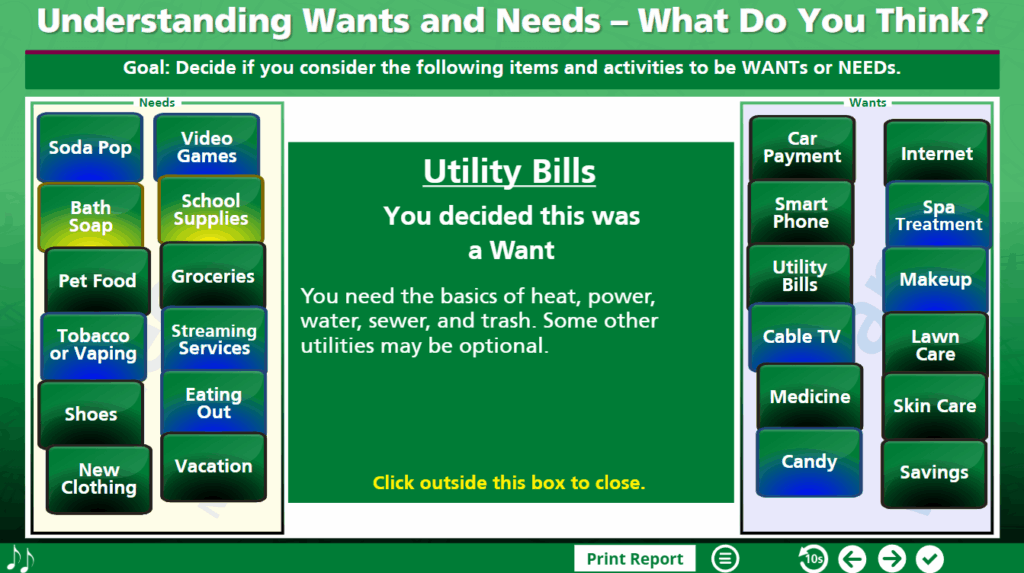

Instructional Design

The design for the new modules incorporated basic andragogical principles, allowing adult learners more freedom over their decisions, making the topics directly relevant to their own experiences and personal needs, respecting the learners’ time by minimizing excessive text and unnecessary reading, and including a diverse array of relatable characters to help boost engagement. Interactive elements were incorporated to enhance the sense that the information was made relevant to the individual learner.

Text-Based Storyboard

The storyboard for this project was represented by the general text narrative I developed to encompass the curricular content and weave relatable scenarios to scaffold learning into a familiar context.

Prototype

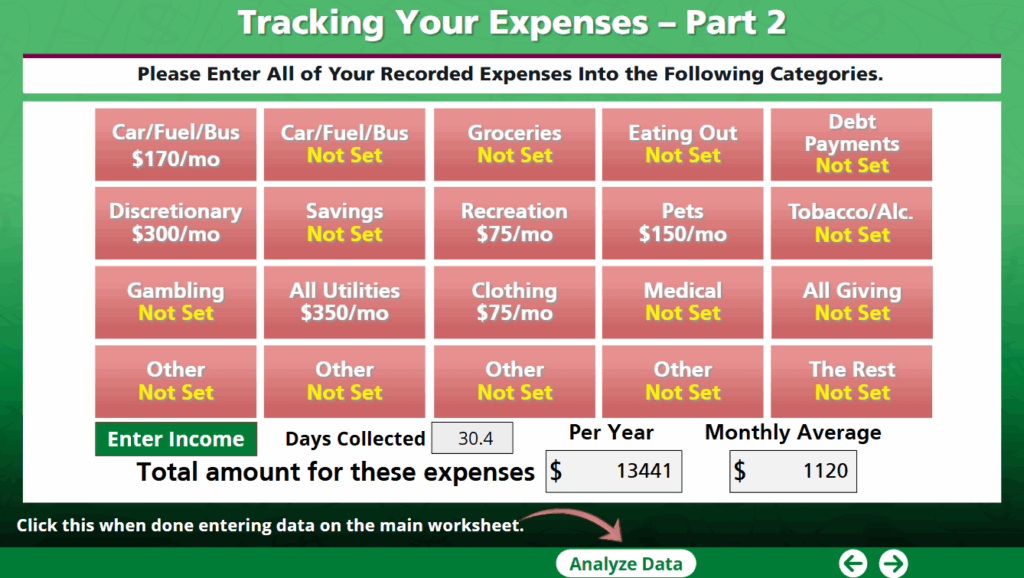

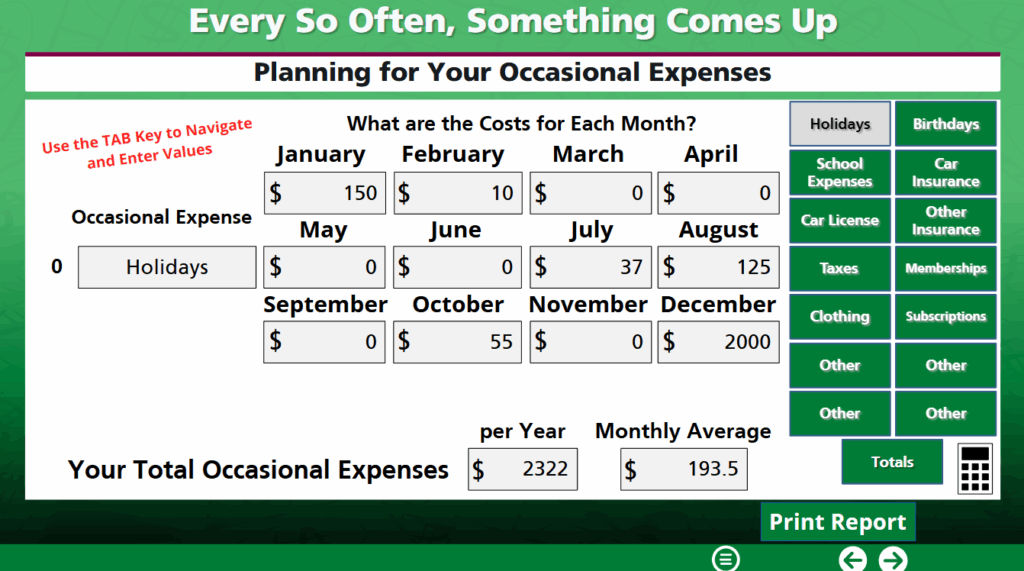

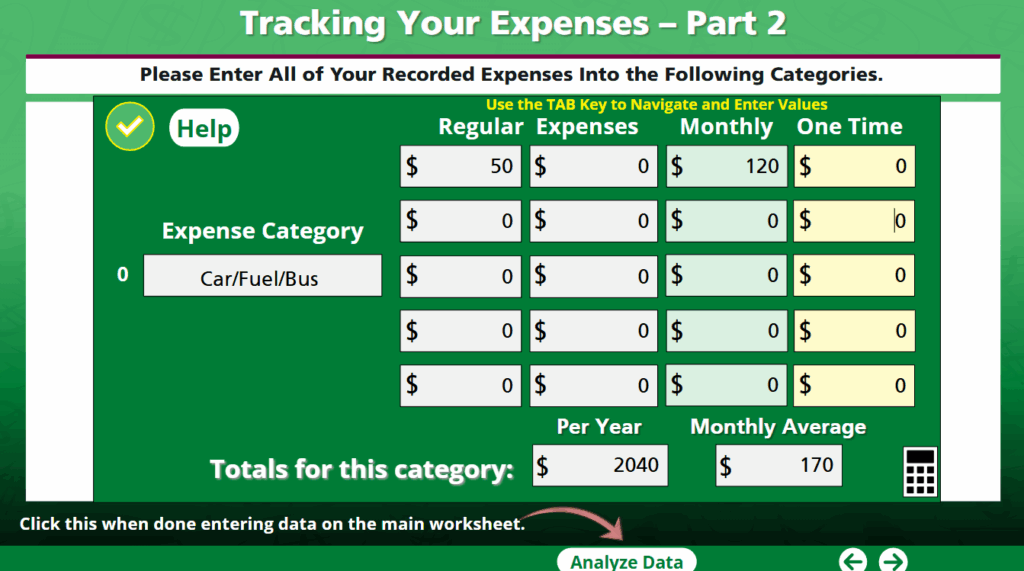

Since a large component of this project centers on financial calculations, much of the prototyping focused on finding a balance between friendly user interfaces and functional data entry within the software platform. Storyline is not very well suited for robust data entry and management, but with some custom JavaScripting it can be made manageable using built-in UI elements.

Final Product

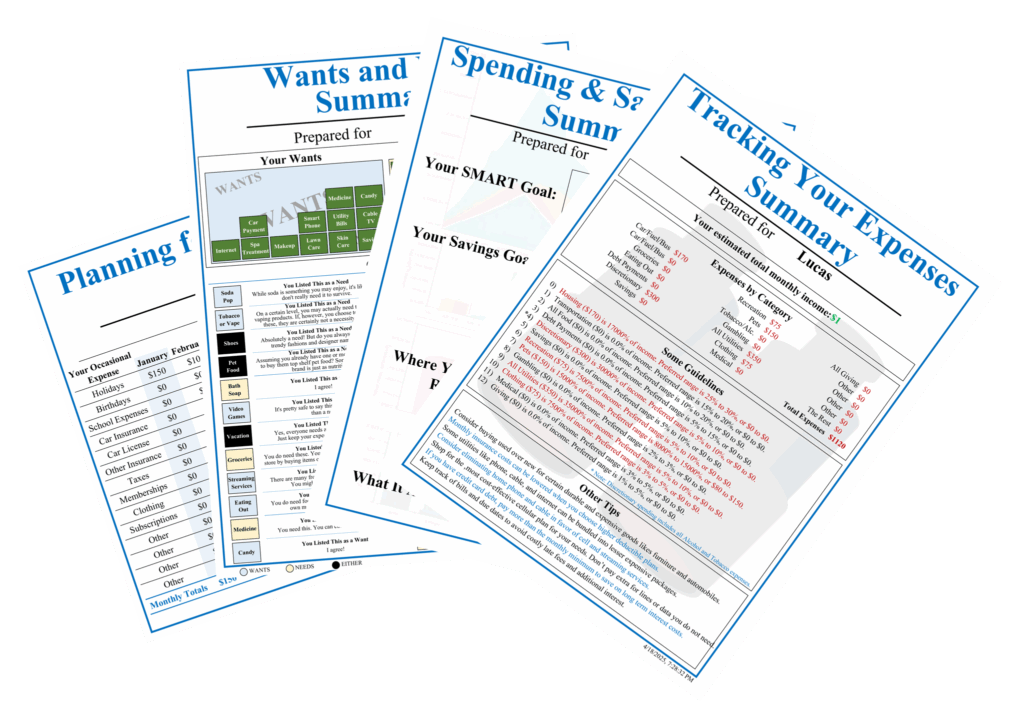

The final product was delivered as a set of microlearning modules, largely with open selection of what order topics could be selected. This freedom helps learners address there most pertinent needs first, establishing the relevance of the learning experience, and helped to maintain engagement through the later modules when additional less interesting topics may be covered.

A combination of narrative led education, punctuated by relevant media elements and interactive worksheets helped to simulate the experience that learners would have received had they attended an in-person workshop. FInally, a collection of professionally formatted reports (courtesy of some additional custom coding) provides a deliverable reward to learners, and provides them a tangible goal to acquire at the end of several of the submodules.

Client Testimonial

{Optional paragraph summarizing client feedback or comments on final product}

Results and Takeaways

This project was implemented on an open access Moodle site, allowing maximum reach to a wide, multi-State audience.

Providing learners with even a modicum to financial literacy tools can vastly improve their financial outlook, and greatly increase the likelihood of setting and achieving personal goals.

This project began early in my JavaScripting journey. Much of what was developed could benefit from refactoring or entirely reworking the logic behind the worksheet calculations. There are other, more elegant spreadsheet solutions available, but the tradeoff with this is increased difficulty with their integration with Storyline. Given more time, or an opportunity to update and over haul this project, this may be a more viable course to take.